Your Year-End Financial Reset: Start 2025 Strong With Updated Savings Limits and a Clear Plan

Summary

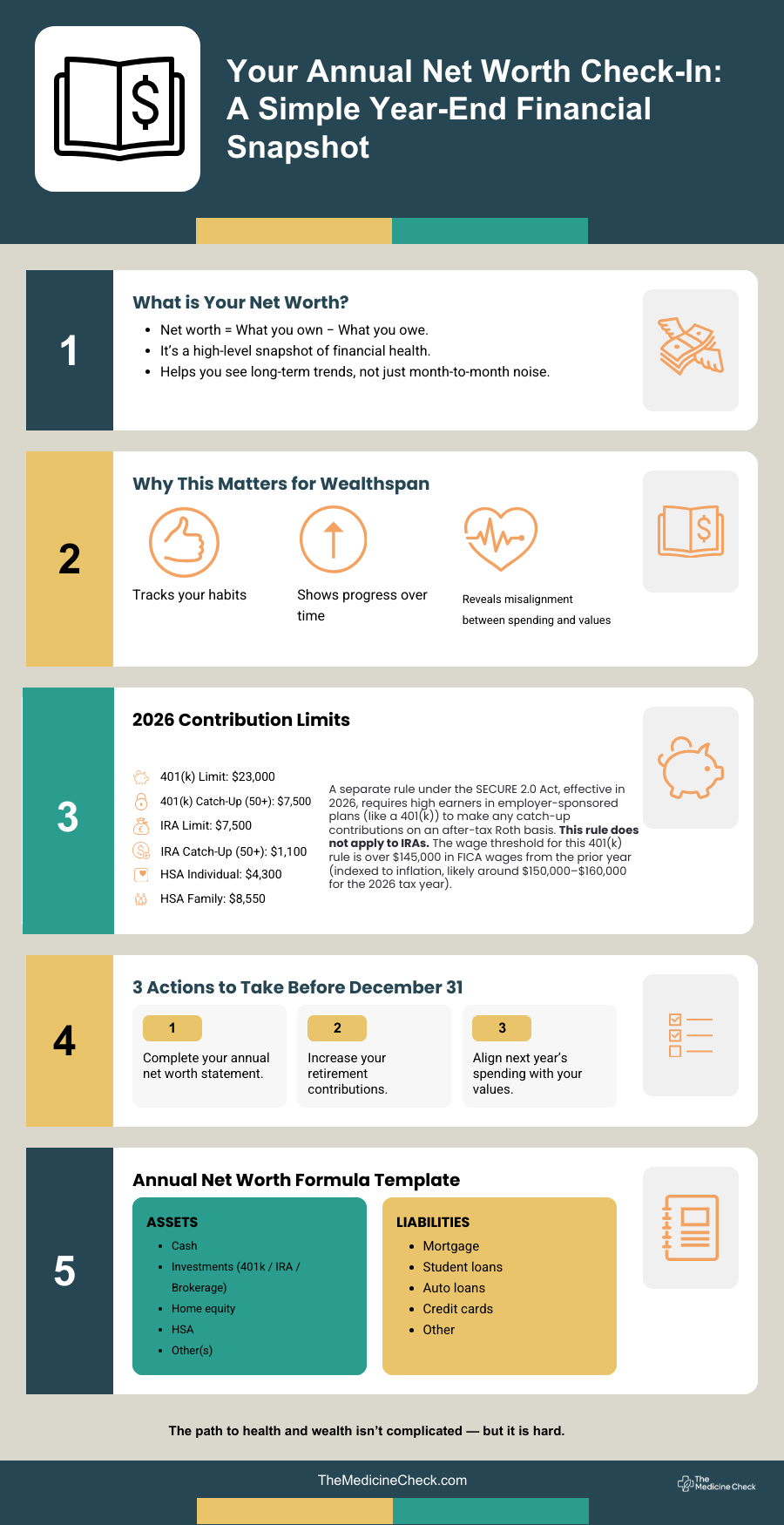

The end of the year is the perfect time to take control of your financial health. With new 2026 retirement and HSA contribution limits now in place, this is your opportunity to adjust your savings, review protections, and realign your money with your values. A simple year-end financial reset can dramatically improve your long-term independence and wealthspan.

Why a Year-End Reset Strengthens Your Wealthspan

Just like an annual physical helps you catch problems early and stay on the right track, a year-end financial checkup helps you measure your progress and prepare for the year ahead. Reflection is one of the most powerful tools in behavioral finance. When we pause to look at what went well, what didn’t, and where our money actually went, we gain clarity — and with clarity comes better decisions.

A short year-end review helps you understand whether your spending matched your values, whether you increased your net worth this year, and whether your financial habits supported the life you want to live. This process creates a foundation of self-awareness that strengthens both your present well-being and your long-term financial independence.

Update Your Savings Strategy With the New 2026 Contribution Limits

A new year brings new IRS limits — and increasing your retirement savings, even slightly, can dramatically change your long-term wealthspan. Here are the updated 2026 contribution limits you should know:

2026 Retirement Contribution Limits

401(k), 403(b), 457(b):

$23,000 annual limitCatch-up (age 50+):

$7,500

⭐ Important Note for High Earners

Under SECURE Act 2.0, if you earn more than $145,000 (adjusted annually) from the employer sponsoring your plan, your catch-up contributions must be Roth, not pre-tax.

That means:

Your first $23,000 can still be traditional pre-tax (if you choose)

Your $7,500 catch-up will be deposited as after-tax Roth, giving you tax-free growth later

Benefits of Roth catch-up contributions:

✔ Tax-free withdrawals in retirement

✔ Helps diversify tax exposure

✔ Avoids required minimum distributions on Roth 401(k) starting in 2024+

2026 IRA Limits

Traditional & Roth IRA: $7,500

Catch-up (age 50+): $1,100

(Catch-up for IRAs is not required to be Roth.)

2026 HSA Contribution Limits

Individual: $4,300

Family: $8,550

Catch-up (age 55+): $1,000

Build Your 2026 Foundation: Review Protections and Automations

Once your savings strategy is aligned with the new limits, take a few minutes to review your key “financial health protections.” These guardrails support your independence as you age and prevent avoidable financial surprises.

Ask yourself:

Is my emergency fund still adequate?

Are my insurance protections up to date: health, disability, life, long-term care?

Have I reviewed my beneficiaries this year?

Are my cybersecurity habits strong enough (passwords, 2FA, credit monitoring)?

Are my automatic savings, retirement contributions, and debt payments still aligned with my goals?

These steps are the financial equivalent of preventive medicine — simple actions that reduce future risk and strengthen your wealthspan. And now is the best time to implement them before the new year begins.

An infographic highlighting changes and important actions to take before the new year

Three Steps to Start This Week

If you’re ready to step into 2025 with confidence, start here:

Increase your retirement contribution (even 1%) to match the new 2026 limits.

Review your automations — savings, investments, and recurring bills.

Complete a quick “financial reset hour” to update protections and beneficiaries.

The path to health and wealth isn’t complicated — but it is hard.

👉 Subscribe to The Medicine Check for weekly wealthspan guidance.