Financial Recovery Matters: Building Wealthspan Without Burnout

Summary

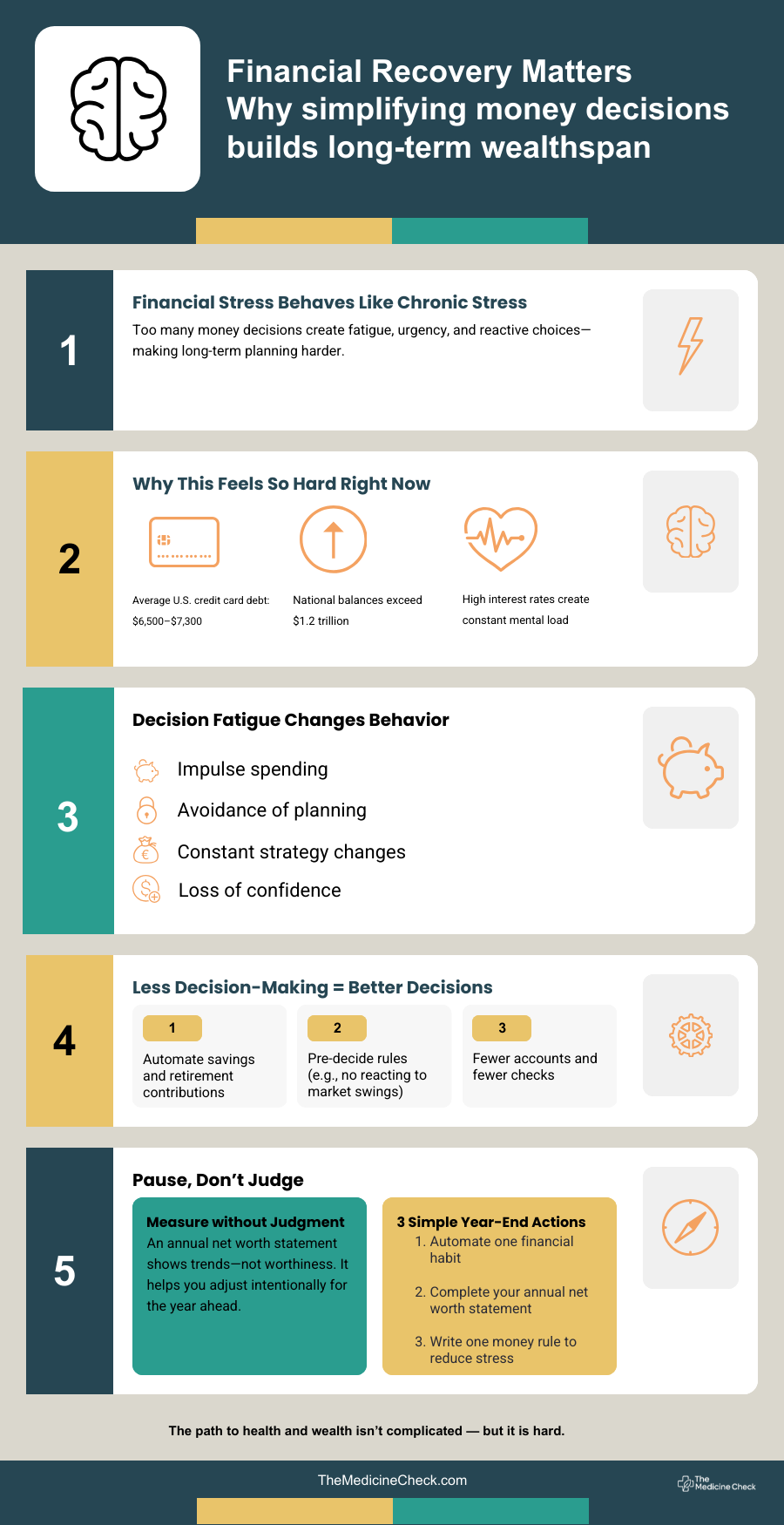

Just as physical health requires recovery, financial health requires space, simplicity, and sustainability. Constant checking, tweaking, and reacting to money decisions can create stress, decision fatigue, and burnout—ultimately undermining long-term wealth. Wealthspan isn’t built by doing more; it’s built by creating systems that work quietly in the background while you focus on living your life.

Financial Stress Behaves Like Chronic Stress

Financial stress activates many of the same cognitive and emotional pathways as chronic physical stress, pushing the brain into short-term thinking and reactive behaviors. One particularly common stressor is rotating credit card balances. In 2025, the average U.S. consumer carrying credit card debt held roughly $6,500–$7,300, and total national credit card balances exceeded $1.2 trillion, reflecting widespread reliance on credit for everyday expenses and emergencies. Carrying high-interest credit card debt—often above 20% APR—creates an ongoing mental load and persistent stress that influences how people think about money and decisions.

This psychological burden can lead to impulsive decisions, avoidance of long-term planning, or postponing important financial actions like saving for retirement. When every dollar decision feels urgent, the brain shifts into short-term thinking, and thoughtful, intentional choices become harder to make. Over time, this combination of stress and reactive behavior can erode financial resilience and shorten your wealthspan just as chronic physical stress accelerates aging.

Systems Beat Willpower Every Time

Willpower is a limited resource. Wealthspan improves when decisions are simplified and automated.

Automatic retirement contributions, scheduled transfers to savings, and clearly defined rules (“I don’t change my plan during market swings”) reduce cognitive load and emotional interference. These systems create consistency—not perfection—and consistency is what compounds over time.

Fewer decisions don’t mean less control. They mean better control, applied where it matters most.

December Is a Reset Point, Not a Judgment

The end of the year is an ideal time to pause—not to critique, but to observe. An annual net worth statement provides a clear snapshot of progress without day-to-day noise. It allows you to identify trends, measure alignment with values, and make intentional adjustments for the year ahead.

This isn’t about comparing yourself to others or chasing arbitrary targets. It’s about understanding where you are so you can choose where to go next—with clarity rather than urgency.

Infographic showing the importance of Financial Recovery

Simplify to Strengthen Your Wealthspan

Before the year ends, choose one small step:

Reduce decision fatigue by automating one financial habit

Complete an annual net worth statement to track progress over time

Clarify one money rule that protects you from stress-driven decisions

The path to health and wealth isn’t complicated — but it is hard. Sustainable systems make the hard parts easier to maintain.