Clarity Before Change: A Calm Financial Start to the New Year

Summary

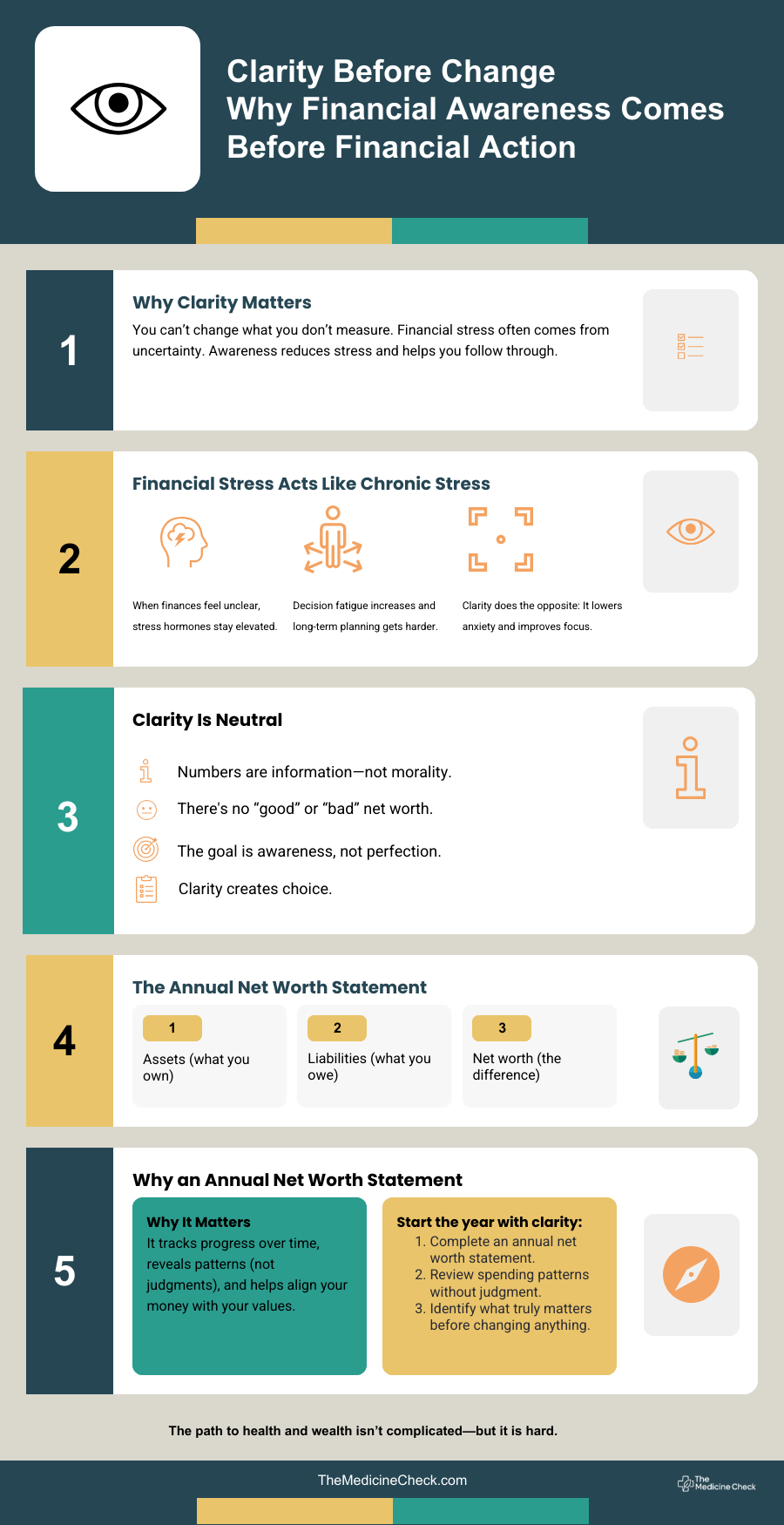

The start of a new year often comes with pressure to act quickly. To set goals, make changes, and “fix” finances all at once. But lasting wealthspan doesn’t begin with action. It begins with clarity. January is most useful when it’s treated as a time for understanding, not urgency. Clear awareness creates better decisions, reduces stress, and lays the groundwork for sustainable financial health.

Why Change Without Clarity Backfires

Many financial changes fail not because they’re poorly intentioned, but because they’re rushed. When people jump straight into budgeting, investing changes, or aggressive saving goals without first understanding their current situation, frustration follows quickly.

This mirrors what we see in health: interventions work best when they’re targeted and measured. Without clarity about cash flow, debt, or net worth, financial decisions become reactive. People overcorrect, abandon systems, or avoid finances altogether. Clarity slows things down just enough to make progress possible.

What Financial Clarity Actually Means

Clarity doesn’t require spreadsheets or complex tools. It means being able to answer a few foundational questions:

What is coming in, and what is going out?

Where is money creating stress?

What systems are already working?

This is why an annual net worth statement is so powerful. It provides a snapshot of financial structure (assets and liabilities) without daily noise. Over time, these snapshots show trends that matter far more than short-term fluctuations. Like tracking health markers, financial clarity comes from patterns, not perfection.

January Is for Observation, Not Optimization

The beginning of the year offers something valuable: space. Fewer holidays, fewer disruptions, and a natural pause point. This makes January an ideal time to observe without judgment.

Instead of setting multiple goals, consider identifying friction. What feels unnecessarily stressful? Where are decisions happening too often? What could be simplified or automated later? Change is far more effective when it follows understanding.

An infographic to help you start the year off right!

Start With Clarity

As the year begins, choose one simple step:

Complete an annual net worth statement to establish a baseline

Observe cash flow patterns without trying to fix them yet

Identify one source of financial friction to address later

The path to health and wealth isn’t complicated — but it is hard. Clarity is what makes change sustainable.